Kerry W. Pulliam, CFP®, AEP®, CEPA

📧 Kerry.Pulliam@CapitasFinancial.com

📞 502-599-6623

Navigating the Challenge: When Executive Benefits Become Entitlements

As advisors, we often see executive benefit plans designed with the best intentions—to incentivize and retain key talent. Yet, for many privately held businesses, especially multi-generational ones, these plans can quickly evolve into perceived entitlements, viewed more as a necessary expense than a strategic tool.

But what if these plans could actually drive EBITDA growth, align key people directly with shareholder goals, and provide measurable value to the business?

This guide will walk you through a proven approach using a Performance Units Plan (PUP), illustrating how we successfully transformed a perceived cost into a significant value driver for a third-generation family-owned power company.

The Advisor's Role: Identifying the Core Problem

Your business-owner clients likely face common challenges with traditional compensation or retention strategies:

-

Retaining Key Non-Family Talent: How do you keep top performers without diluting ownership?

-

Recognizing Next-Gen Family Leadership: How do you reward rising family leaders working in the business effectively?

-

Avoiding Short-Lived Bonuses: How do you prevent a bonus plan from becoming an expensive, recurring entitlement with limited long-term impact?

The FLIGHT Path Solution: A Strategic Diagnostic Approach

Our FLIGHT diagnostics process provides a structured way to address these challenges and implement solutions like a Performance Units Plan (PUP):

-

Foundation of Knowledge: It starts with a deep understanding of the client's business, their goals, and the specific dynamics of private and family-owned enterprises.

-

Leverage Collaborative Team: Work along business owners team to quantify cost of status quo.

-

Identify Indicators & Implications: Pinpoint where the current structure falls short and how a new plan can directly impact key business metrics and long-term value.

-

Guide Client Through Process: Clearly communicate the plan's mechanics, benefits, and ongoing management, ensuring the client is fully engaged and understands the "why" behind the strategy.

-

Holistic: Design a plan that integrates seamlessly with the client's overall succession, wealth transfer, and business growth objectives.

-

Transformational & Tax Efficiency: Shift the client's perspective from viewing executive benefits as a liability to a strategic asset that drives growth and is structured for optimal tax outcomes.

In the case of our power company client, the PUP we designed tied rewards directly to their 3-year rolling adjusted EBITDA. Participants received:

-

Appreciation Units: Reflecting only the increase in value since the grant date, rewarding growth.

-

Full Value Units: Including both base value and appreciation, used selectively for specific, high-impact roles.

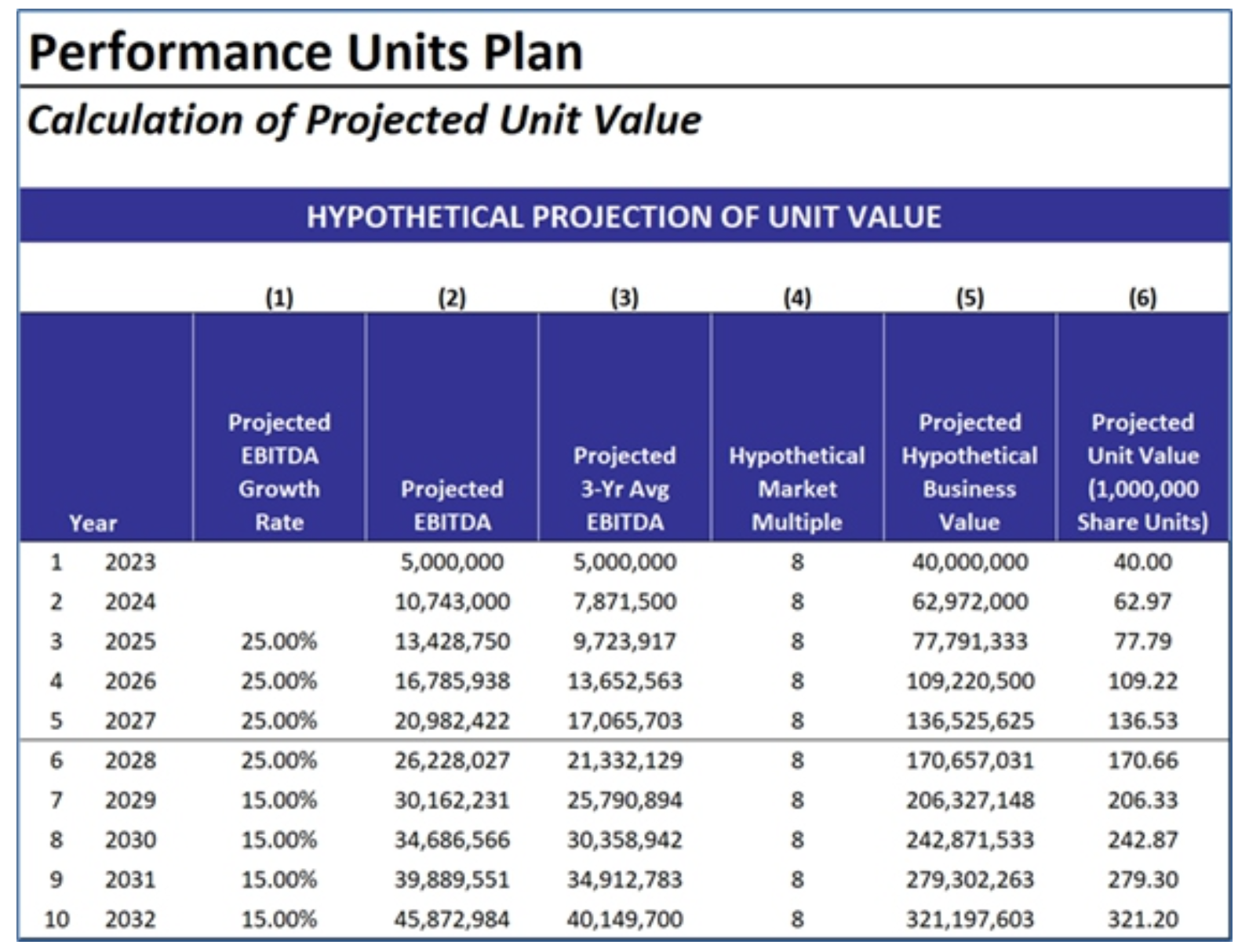

Illustrative Example for Your Client Discussions: The Projected Unit Value Table

To help your clients visualize the power of a PUP, share this simplified model. It demonstrates how consistent EBITDA growth can compound participant value, turning a retention strategy into a significant wealth-building mechanism linked to enterprise value.

📈 This table is a powerful tool to illustrate how a sustained EBITDA growth rate transforms a plan from a "cost" into a clear, compounding asset for participants—directly aligned with the owner's goal of increasing company value.

Why This Strategy Resonates with UHNW & HNW Business Owners

This approach provides clear benefits that appeal to sophisticated business owners:

-

Direct Alignment with Value: Rewards are inextricably linked to the company's financial performance, ensuring every dollar spent on retention directly supports business growth.

-

Enhanced Retention: A multi-year vesting schedule (e.g., 5-year) secures key talent for the long term, reducing turnover costs and preserving institutional knowledge.

-

Transparency & Engagement: Regular performance statements keep participants informed and engaged, fostering a sense of shared purpose and ownership in the company's success.

-

Financial Predictability: The plan's liability is fully modeled and funded, providing owners with clear foresight and control over future financial commitments.

Your Next Step: Initiating the Value Conversation

For advisors serving closely held businesses, framing executive benefit plans as value drivers is a powerful differentiator. It shifts the conversation from expense management to strategic growth.

Consider opening your next client discussion with a question like:

"What would it look like if your current executive retention plan actually increased your company's value?"

This simple question can unlock deeper conversations about synthetic equity, performance-based compensation, and sophisticated funding strategies. If you're ready to explore these concepts for your clients, I'm here to be a collaborative, behind-the-scenes resource.